Get In Touch

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge

If you are planning to buy a home in South Africa, you might be wondering how to finance your purchase and what are the best options available for you. We’ll explain why you should use a bond calculator and MultiNET Home Loans to you secure your dream home.

What is a bond calculator?

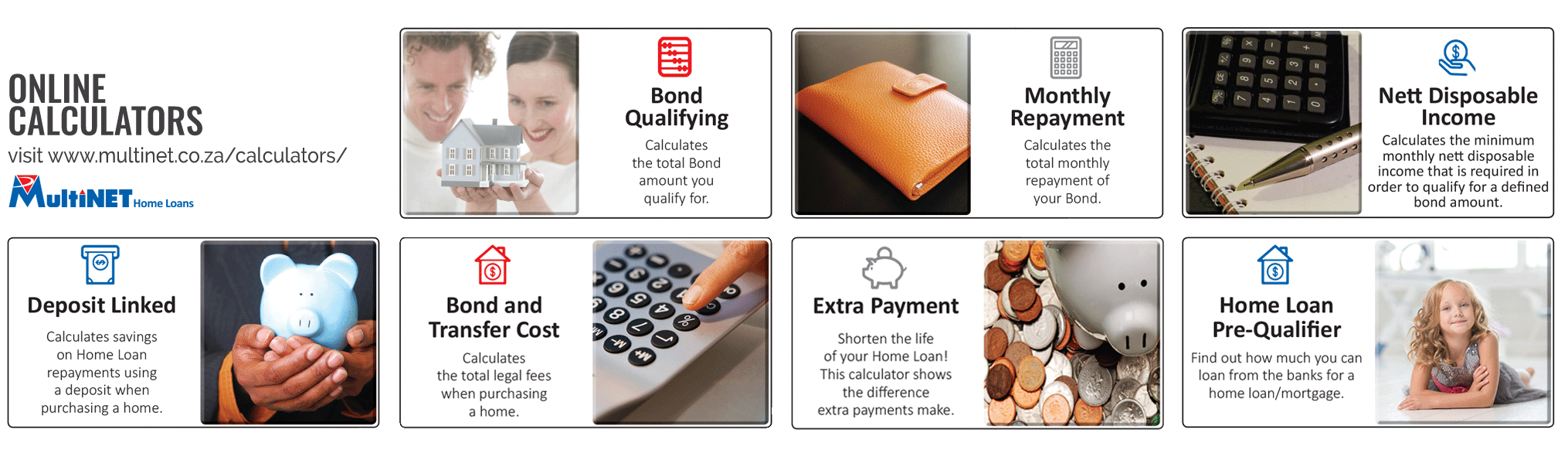

A bond calculator is an online tool that allows you to estimate your monthly bond repayments, based on the purchase price, the bond amount, the interest rate, and the repayment term of your home loan. A bond calculator can also help you determine how much you can afford to borrow, based on your income and expenses, and how much you will need to pay in bond registration and property transfer costs.

A bond calculator can give you a quick and easy overview of your financial situation and help you plan your budget accordingly. However, a bond calculator is only a guide and does not guarantee that you will qualify for a home loan or that you will get the interest rate or terms that you want. That’s why you need a bond originator to assist you with the actual application process.

What is a bond originator?

A bond originator is a professional who acts as an intermediary between you and the lenders, such as banks or other financial institutions, that offer home loans. A bond originator will assess your financial profile, compare different home loan products from various lenders, negotiate the best interest rate and terms for you, and submit your application to the lender of your choice.

A bond originator will also handle all the paperwork and communication with the lender on your behalf, saving you time and hassle. A bond originator will also advise you on the best way to structure your home loan, such as whether to pay a deposit, how to reduce your monthly repayments, or how to save on interest over the long term.

Why use a bond calculator and a bond originator?

Using a bond calculator and a bond originator can have many benefits for you as a home buyer in South Africa. Here are some of them:

How to use a bond calculator and a bond originator?

Using the MultiNET bond calculator and services is easy and convenient. All you need to do is follow these steps:

Buying a home is one of the most important decisions you will ever make in your life. That’s why you need to make sure that you have all the information and assistance you need to make it happen. Using a bond calculator and MultiNET Home Loans can help you achieve your homeownership goals faster, easier, and cheaper than doing it on your own.

So, what are you waiting for? Visit MultiNET Home Loans www.multinet.co.za today and start your journey towards owning your dream home in South Africa!

For more information: 0861 54 54 44 | www.multinet.co.za | info@multinet.co.za

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge