Get In Touch

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge

The property industry was one that outshined the impact of the pandemic and experienced a record number of sales over the past two years. In 2019 the total registered property sales was R219 billion this excludes properties sold to the value of R250 000 and below. In 2021 we saw over R300 billion in registered transactions, the property market being the largest contributing growth of between R1.2 and R2.2 million.

To predict the future, we need to look back to the past and understand what caused this astonishing 36% growth during a time where the unemployment rate is the highest in our history; experiencing a shutdown of our country during looting; and the lowest business confidence index recorded in years.

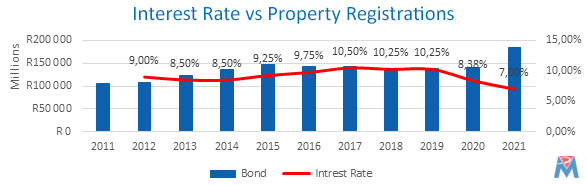

It all comes down to money, the cost of money to be exact and the willingness of our financial institutions to borrow that money. Yes, we all aspire to own our own home and to move up the property ladder, however not all of us could afford to do so, simply put, at a 10.25% interest rate you needed to earn R39 265.00 to qualify for a R1.2 million home loan, but at a 7% you only need to earn R31 011.00 to afford the same property.

And what is the major driver of this cost of money, Inflation! The higher the inflation rates the more the SARB needs to curb the growth and the higher the interest rate will go and as we can see in the graph above the property volumes go hand in hand with the interest rate.

Now looking to the future, we need to consider the following, what would impact the inflation rate and how will the SARB respond to this, and lastly will the financial institutions continue taking risks in borrowing money to potential property owners.

Let’s deal with the first impact, inflation. During the past two-years supply could not keep up with demand and the impact of this is higher prices, compound that with a weaker rand and higher fuel cost and we are already in an inflation band higher than the SARB’S 3.5 – 4.5% target range. And to curb this inflation growth we will need to raise interest rates and thus the first 0.25% hike in November 2021 occurred. However, inflation is not something that you can stop with just one interest rate hike, inflation takes time to curb, and the SARB needs to make decisions now to have an impact far in the future.

The short answer to this scenario is that over the coming months we will see a gradual increase in rates and as history has shown, so we will see the reduction in property sales. As money becomes more expensive to borrow, the financial institutions will need to take this into account when considering lending to consumers and eventually reducing the amount of people that can afford to buy a property.

What does this mean for property owners looking to sell, we believe that currently the prices for properties are at its peak, and for those looking to get the best return for their money the time to sell is now.

For those consumers looking to buy property I would advise that if you can afford a property at a higher rate call it 10% then you should wait as property prices will come down when the rates increase. However, for those consumers that would not qualify for a loan at the higher rate the time is now but remember that you will be buying at the high of the market and will need to potentially keep the property for longer until the next cycle starts.

The next 3 years will be an interesting time in the property industry and for those working in it, keep your cost low, maximise your commission earnings and join a company that lives by those values.

To find out more about partnering with MultiNET Home Loans visit www.multinet.co.za. Contact us on 0861 545 444 or WhatsApp us on 061 537 8778

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge