Get In Touch

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge

July 2021. So far 2021 has been another challenging year for the South African economy, unemployment rates are at its highest levels, tourism and hospitality have been severely affected by the Covid pandemic and political instability has taken its toll on the countries recovery objectives.

“Despite all the turmoil the residential property industry has performed better in the first six months of this year than what it has performed in the last 10 years for the same period. The demand for property has continued to maintain its momentum since coming out of hard lockdown in June last year,” says Shaun Rademeyer, CEO of MultiNET Home Loans.

“The average home loan submission increased by 57% in the last quarter of the 2021 financial year and continued to grow by a further 5% for both Q1 and Q2 of this financial year. The outlying reason for this growth is most certainly the low repo rate. At a 50 year low the cost of capital has become the most affordable it has been in the past five decades, coupled with many first-time home buyers taking advantage of the favourable lending environment, and the banking industries resilience and competitive stance for market share, has favoured the residential real estate industry,” Rademeyer explained.

According to Rademeyer the high demand has also had a significant impact on the property prices. Since 2019 MultiNET’s average approved home loan has increased by 18%, and the property industry has achieved a 14% growth in average registered bond amount for the same period.

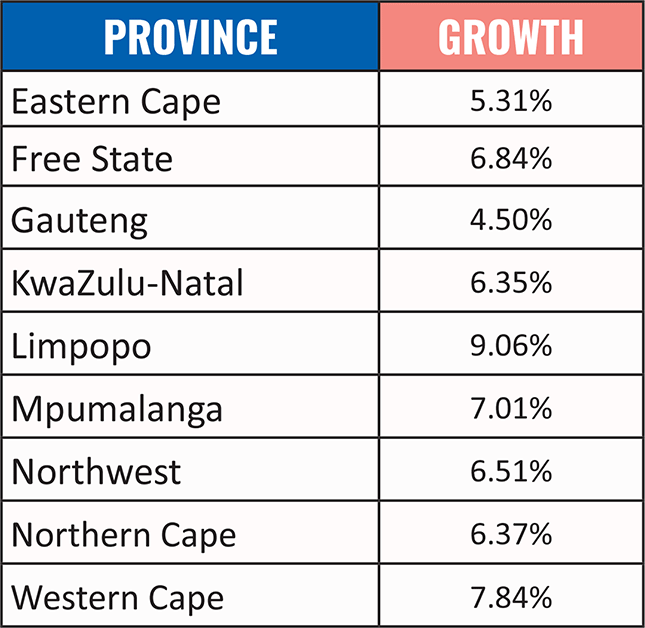

“The bonded property registered in the past 6 months has shown a 6.64% average growth with Gauteng showing the lowest growth percentage out of all the provinces at 4.5%, which could indicate a higher amount of interprovincial movement because of the new work-from- home environment we find ourselves in.

“We have however seen a slowdown in submission over the past two months as the third wave takes its toll on the country. We know that winter months including school holidays generally influences the residential property industry, this however could be the start of the downturn in the property industry. Whilst consumers can still take advantage of the low cost of capital, the high unemployment rate and low consumer confidence may have a negative impact on the property boom which we have seen since the start of lockdown,” he explained.

As international property markets allude to property bubbles potentially being experienced by higher-than-normal price inflations. The slowdown in the South African property market and a potential interest rate hike at the end of 2021, could benefit the first-time home buyers being able to negotiate a more favourable property price.

“Whichever way we look at the residential property industry, it remains an outlier in the current economic climates, and with the SARB looking to assist South African consumers by keeping repo rates as low as possible, home-buyers will be able to take advantage of the low interest rate even with a 50 basis point increase,” Rademeyer concluded.

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge