Get In Touch

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge

March 2021. According to Shaun Rademeyer, CEO of MultiNet Home Loans, the notion of pent-up demand driving the current residential property boom has long been thrown out the window, with everyone now asking how long this trend will continue.

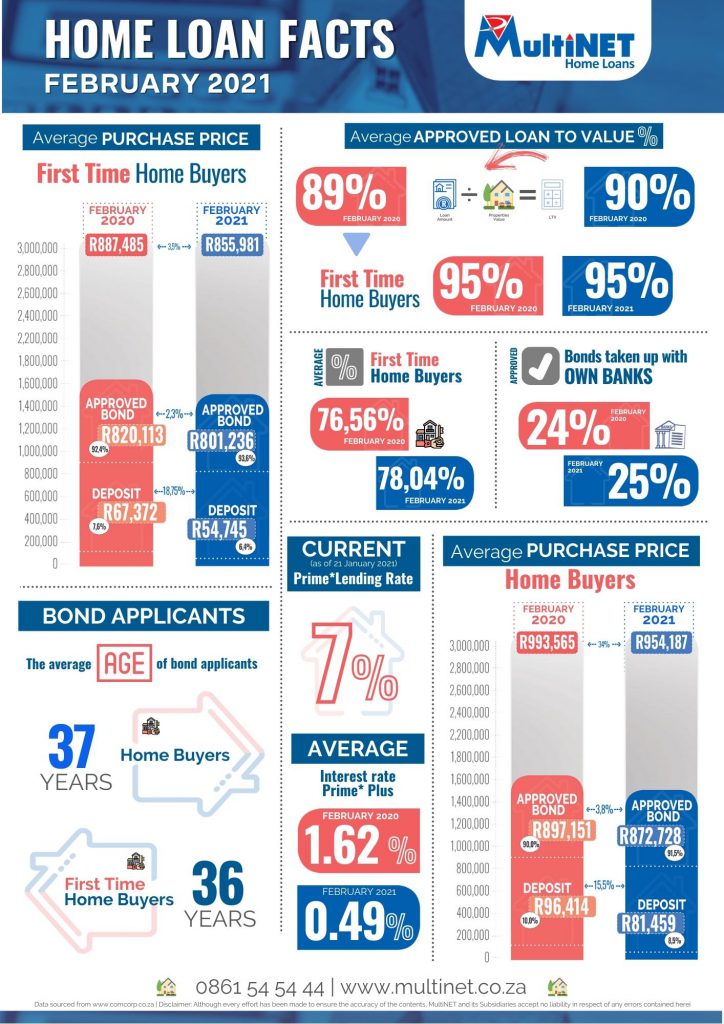

He believes that we will continue to see this boom throughout the 2021 financial year, saying that MultiNet has already noted a 1.5% increase in the amount of first-time home buyers, as well as an increase in average approved loans to property value.

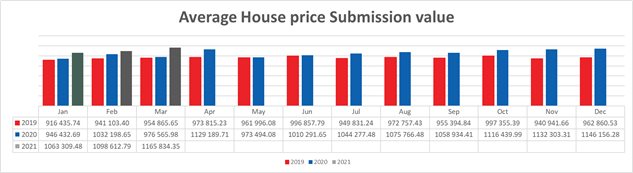

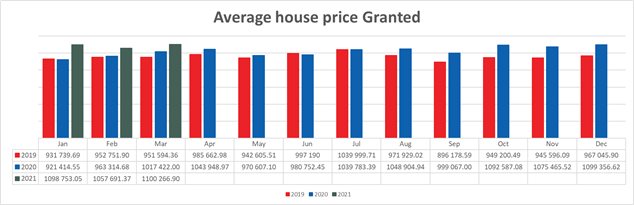

“March is the start of the new financial year for SA as a whole, and we can already see that the home loan submissions have almost doubled compared to the same time last year. Yes, the last week of March last year was the start of our lockdown and the increase is taking this into account, however we are already 27% above the previous year’s average.

“As we move through the property cycle in the latter part of this year, we will find that supply will start surpassing demand and property prices could come under pressure again. The banks’ payment holidays are coming to an end and many developments that stood still during lockdown will be launching in the market.

“It’s unfortunate that our economy will not be growing fast enough to sustain the demand and eventually we will see the market slow down,” says Rademeyer, “However, we will still look forward to a good year and expect to assist many as they purchase the first, second or even fourth homes.

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge